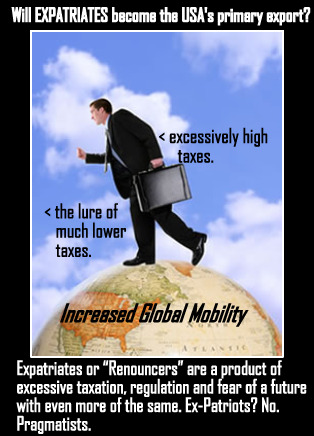

Increasing numbers of United States citizens are renouncing their citizenship to escape onerous taxes, and to pursue better employment opportunities in the global economy. This will ultimately result in a "brain drain," a shrinking tax base, a loss of skills, a loss of employment, an increased need for the engine of entrepreneurship (the only positive result of this exodus), an increased tax burden on the middle-class and suburbia, a further fading away of the American Dream, and a variety of other changes to the American way of life.

I cannot find fault with the expatriates, who are making a painful choice in the interests of their fiscal survival; but I do find fault with government policy, fiscally irresponsible custodians of savings and financial institutions, an uncertain tax environment and a variety of other factors.

This is not even a political issue. As a brilliant former cigar-smoking occupant of the Oval Office once proclaimed: "It's the Economy, stupid!" It's all about money.

An excerpt from a recent article in the Wall Street Journal follows. After you've had a chance to view it, please return to this page for some really fascinating news and commentary which will ultimately affect you -- yes, you:

--------------

THE RENOUNCERS*: THE LIST IS OUT - WHO GAVE UP US CITIZENSHIP AND WHY.

The latest list of renouncers is out.

One is a buyout specialist at the Carlyle Group, another a private equity executive at J.P. Morgan Chase. There’s also a big-law partner, an international socialite, an Israeli Supreme Court justice and a London-based artist.

Each one recently renounced U.S. citizenship or turned in a long-held “green card” conferring permanent-resident status in the U.S. Their names appeared on a quarterly list published last Friday by the Treasury Department, as required by law since 1996.

The list contained 189 names, far fewer than other recent lists. Some experts speculated the number dropped because many Americans who planned to expatriate while tax rates were both low and certain have already done so. (Current tax rates expire at the end of 2012.) Because there’s about a six-month delay between a renunciation and publication on the Treasury’s list, other experts expect a surge latter this year.

The first list for 2012 revealed renunciations by Facebook co-founder Eduardo Saverin and by Denise Rich, the ex-wife of commodities trader Marc Rich. Saverin now lives in Singapore and Rich is a citizen of Austria, according to their spokesmen.

Few people in a sampling of names on the new list contacted by The Wall Street Journal were willing to discuss why they expatriated. They included Carlyle Group managing director Gregory Zeluck, a buyout specialist based in Hong Kong; Myron Zhu, head of private equity at J.P. Morgan Chase in Hong Kong; Bradley Fresia of Fidelity Worldwide Investment in Asia; and Dorothea Koo, an attorney at Baker & McKenzie in Hong Kong.

More than 80 names on the new list appeared to be Chinese, and experts offered possible explanations for the concentration. A prominent one is taxes: The top income tax rate in Hong Kong is 15%, with no tax on capital gains, dividends or estates. In addition, there’s no tax on foreign earnings unless they’re brought back—unlike in the U.S.[read the entire WSJ article]

---------------

* I don't know if it's just me, but 'The Renouncers' sounds like a great name for an 80s or 90s band. And don't talk to me about the song from the movie Benny and Joon -- that was performed by The Proclaimers. If you'd like, you can hear that one by clicking here. That last piece of music comes to us courtesy of The RadioDAZZ Blog.---------------

In order to bring shame upon those citizens fleeing the US to avoid a frightfully uncertain future, The National Archives And Records Association keeps a record of these renouncers, and this record is open to the public. Look for this sign...

In fact, if you'd like to find the latest list of persons who have renounced their U.S. citizenship (they usually go to a U.S. Embassy at the foreign country of their choice and proclaim in front of some officials that they are willingly and voluntarily divesting themselves of US citizenship, and that they are willing to fully cut ties and sacrifice all of the benefits and protections of the United States permanently, and effective immediately), just look for this publication:

The Department Of The Treasury - IRS Quarterly Publication Of Individuals Who Have Chosen To Expatriate, As Required By Section 6039G. It is even available online if you click HERE. And if the doggone link is broken, heck...here's where to go:

https://www.federalregister.gov/quarterly-publication-of-individuals-who-have-chosen-to-expatriate

Just as a side note, you can probably accumulate a great list of wealthy and powerful clients, customers or investors by going to this source -- but I must advise you against solicitation, spamming and making investment offerings to strangers.

Also, expatriation isn't easy if you truly wish to "satisfy the US legal requirements for a pristine exit". Listen here, those of you whom would rebel against fiscal irresponsibility in your home government, be ye holders of Green Cards or US Passports...

Legal expatriation is not easy. The people on the Treasury Department's list had to prove five years of tax compliance, and they owe an exit tax when they renounce. The tax applies to people with net worth greater than $2 million or whose average annual income for the five previous years is $151,000. (There's an exemption of about $650,000.) Some in Congress want to stiffen these or other penalties.

Think about the pros and cons of becoming an expatriate. Then take command of your affairs, and make a decisive move - either one way or the other.

Also, remember that the relative cost of living in a foreign jurisdiction does not take into effect the bite of income taxes -- it just takes into effect the cost of a comparative market basket of goods and services, which you purchase with your post-tax income. Be certain that you understand the derivation of the statistics, and where they may occasionally be misleading.

Douglas E. Castle for The Internationalist Page Blog

No comments:

Post a Comment